Moneyed Women

Financial wellness plays a crucial role in empowering women to emerge from economic instability and The SOFEI Group is a Money Smart Alliance Member to help adult women gain financial literacy skills in several ways:

- Money Smart Assessment: Learn your financial IQ with FDIC's award-winning money smart program. Money Smart is a suite of 14 games and related resources about everyday financial topics. Click

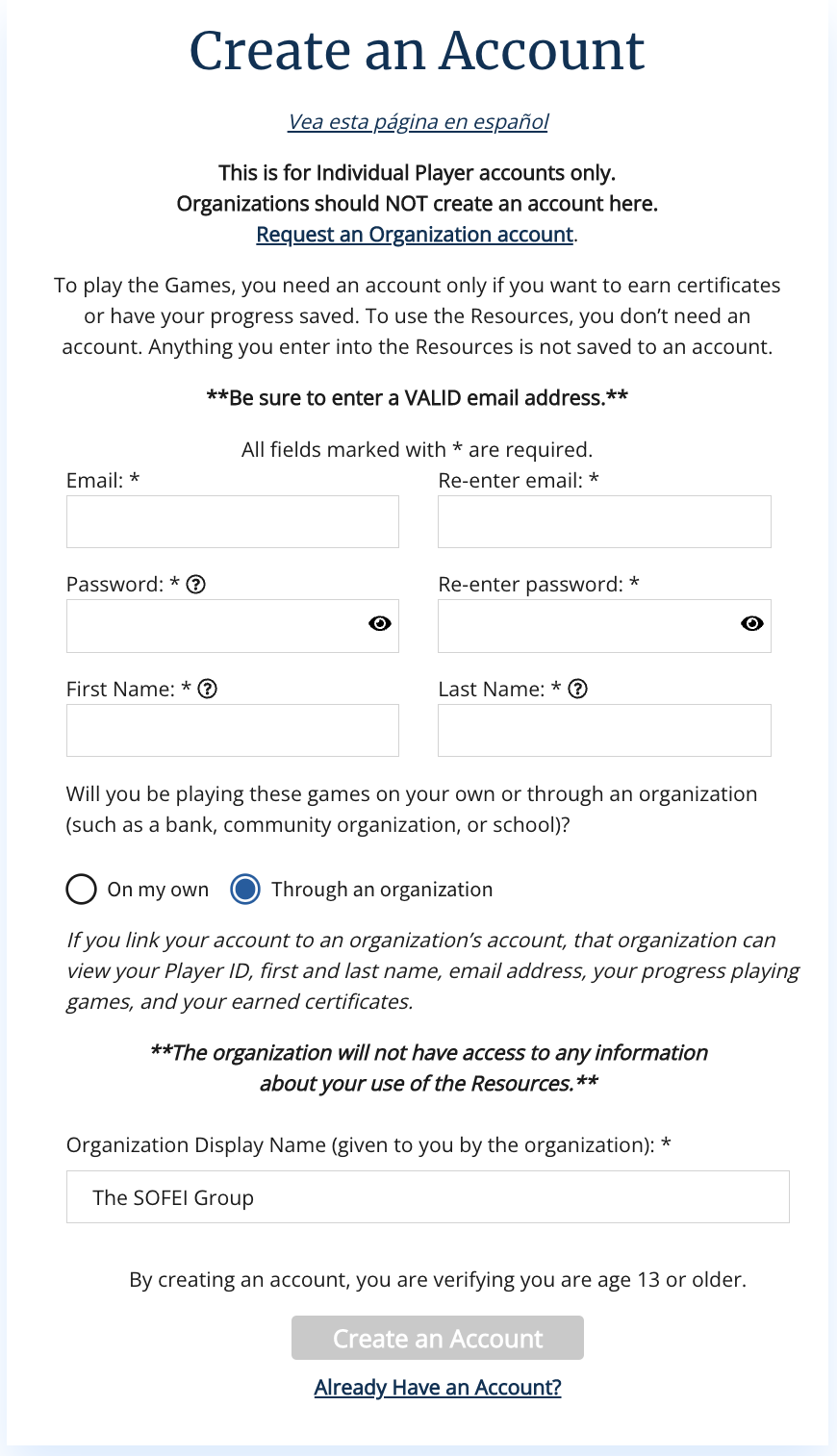

here to create an account to get started. When you create your account, please choose the option to play "Through an Organization" and enter The SOFEI Group to earn certificates and save your progress.

here to create an account to get started. When you create your account, please choose the option to play "Through an Organization" and enter The SOFEI Group to earn certificates and save your progress.

- Economic Independence: Financial literacy equips women with the knowledge and skills to manage their finances independently. By understanding budgeting, savings, and investments, women can gain control over their financial lives and reduce dependence on others, fostering economic independence.

- Closing the Gender Wealth Gap: Financial literacy helps women bridge the gender wealth gap by providing them with the tools to make informed decisions about saving, investing, and building wealth. By understanding investment options and strategies, women can accumulate assets and grow their net worth over time.

- Career Advancement: Financial literacy enables women to negotiate better salaries, benefits, and working conditions, leading to improved career prospects. Understanding the value of their skills and the intricacies of financial negotiations can help women demand fair compensation and advance in their chosen fields.

- Entrepreneurship Opportunities: Financial literacy equips women with the knowledge to start and manage businesses successfully. By understanding concepts like cash flow, budgeting, and access to capital, women can launch and grow their ventures, contributing to economic growth and creating employment opportunities.

- Financial Resilience: Financial literacy empowers women to navigate economic challenges and unexpected life events. Understanding concepts such as insurance, emergency funds, and debt management helps women protect themselves and their families during difficult times, minimizing the impact of financial setbacks.

- Retirement Planning: Financial literacy is crucial for women's long-term financial security, especially considering their longer life expectancy. By understanding retirement savings options and investment strategies, women can plan for their future and ensure a comfortable retirement.

- Breaking Cultural Norms: Financial literacy can challenge societal norms and cultural expectations that may restrict women's financial freedom. By empowering women with financial knowledge, they can assert their rights and challenge gender-based economic inequalities.

By providing women with the tools, knowledge, and confidence to manage their finances effectively, financial literacy enables them to overcome economic inequality. It fosters economic empowerment, independence, and resilience, helping women create a more equitable and prosperous future for themselves and their communities.